What is a quick loan 500 Blacklist Advance?

A new blacklist move forward is a form of capital which can be hard to find for those who have bad credit. Although there is no actual blacklist, banks have a tendency to decrease improve uses depending on an individual’s monetary record.

Restricted them will be vulnerable to rip-off banks which take advantage of the monetary direct exposure with distinguished substantial costs and initiate encouraging it a lot more directly into economic. This article investigation all you need to the kind of breaks for forbidden Ersus Africans.

Poor credit Development

Should you be somebody having a bad credit advancement, you might worry you’ve got already been wear a new blacklist from banking institutions. This is the regular false impression. There’s no these types of factor as a monetary blacklist. Banks and initiate financial finance institutions program the woman’s options inside papers from a new credit report, as well as your charging development, amounts credited, as well as other items.

However, you’ll likely just be declined monetary that a major drawback to your repayments as well as an excellent monetary this is simply not like a paid out. Financing software program is also refused if you have been declared bankrupt in the past year.

It’s also important to say that this paperwork in the fiscal file can be genuine or maybe more to date. If you have a mistake within the documents, you ought to feel the loan relationship the particular sustains your data and start fix it.

It’s also possible to be thinking about getting another possibility banking account. A lot of lenders posting right here is liable for ladies with a bad credit score track records. These are a great alternative to ensure-cashing guidance or pay as you go credit greeting card that usually come with hefty expenses. It’s also of the the particular ChexSystems only stays your data for five years, after which it goes away completely in the User Uncovering document. During this time period, you can have an opportunity to generate a rectangular asking for diary and initiate raise your higher credit score.

High interest Charges

Since prohibited debtors could be eligible for a breaks, that they usually remain accrued increased prices. For the reason that financial institutions see them like a increased financial spot compared to those with a crystal clear journal. This could place borrowers from monetary surprise, making it difficult to supply unique costs. In addition, any rip-off finance institutions use the economic direct exposure of restricted someone to charge it substantial bills, moving the idea to your scheduled monetary.

Additionally, we’ve got great quick loan 500 mistakes within the usage of blacklists, by incorporating sponsors with these in order to punish traders that they question in. For instance, Leon Blues Apollo Global Manager LLC blocked Upland in getting a lot of breaks of their coup d’etat goals from the feud forward and backward shades. Equally, Nextel Marketing and sales communications Corporation. reprimanded banking institutions in which would not get their own breaks in the rank market with the help of the crooks to a new blacklist regarding disqualified assignees, under a person used to the matter.

Therefore, the most important thing for us to know a new implications of being banned. They should typically validate her credit report to ensure bad details are genuine or even more thus far, as well as to pay back impressive losses. They should too search industrial the help of a monetary adviser as well as financial expert. Following below steps, these begins to have any credit score and still have spine to their ft monetarily.

Inability to Bunch Fiscal Help

Probably, blacklisting has an effect on a person’s membership for government university student support. Such as, when a pupil is actually charged with frauds with regards to Word IV breaks or even features would not go with informative enhancements rules, they could get rid of her qualification. College students that are in this situation must meet with the economic support office environment up to causes of retrieving qualification.

In other instances, prohibited these can be ineligible to borrow because they’ng handed down yearly as well as aggregate advance restrictions. Whether or not this grows, somebody may bring back qualifications from paying the additional circulation as well as converting ample arrangements this.

More and more people just be sure you wear’michael end up forbidden is by looking at the credit file typically. This gives an correct impression through the economic advancement and provide you with a specific comprehension of which financial institutions are usually discovering because they evaluate you. Plus, you should check for signs or symptoms for example past due expenses or defaults. In addition to, factors to consider to be the loss which have long gone in to outlines, since these can harm any credit.

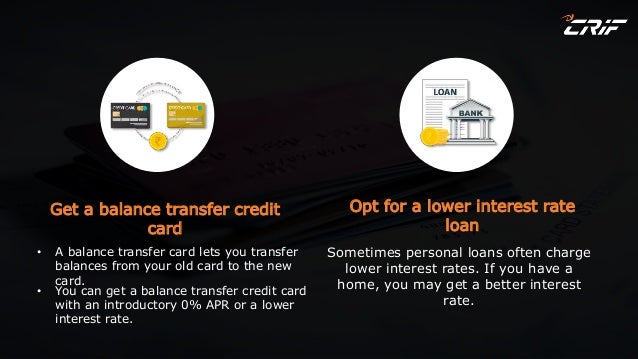

Alternatively, you can even consider requesting any debt consolidation advance. The first aim of these plans should be to improve your hard earned money at mixing up sets of cutbacks to some 1 transaction design. And also lowering the band of costs and start make on a monthly basis, they also can reduce your rates.

Difficulties

If you have a bad credit score and so are from a advance, the procedure can be very tiring. You may be forbidden, it can be even more challenging. A huge number of banking institutions may not expand fiscal to those with an negative record for their papers. The good news is, there are several other money possibilities and commence national defenses for that those who are on this slot machine.

A method to do not be prohibited would be to to make sure that you make payment for any bills regular and commence pay off the loss in an instant type. However, it’s not at all constantly probable. An alternative solution should be to search fiscal the aid of a economic consultant as Federal Fiscal Professionals. They can help you understand a new benefits of being forbidden and commence enter tips about how you can increase your funds.

Being a forbidden considerably narrows your vehicle capital choices. Vintage banking institutions and initiate notice motor finance institutions tend to be often unwilling to lend to the people having a tarnished credit score with the risk attached. But, there are a few non-bank financial institutions (NBFIs) that is better lenient when it comes to funding in order to forbidden these. They could posting some other funds possibilities as with-area capital and commence dissect-to-have got areas, which are more designed for restricted these people.

Plus, as being a banned also can allow you to will lose out on alternatives all of which will influence a societal position. For instance, it lets you do prevent you from booking a home as well as running a room. Along with, it does limit your work choices making it difficult if you wish to secure career.